The UK used car market is a dynamic space where private sellers and dealers work hard to price their vehicles fairly, each facing unique challenges to meet buyer needs. Private sellers bring a personal touch, while dealers shoulder greater responsibility, risk, and value-added services. With factors like Tesla’s recent share price drop rippling through the automotive world, let’s explore why dealers often charge more—and why that premium might be worth it.

Private Sellers: Heart and Hustle

Imagine you’re selling your 2015 Ford Fiesta. You check Parkers or Auto Trader, input the details—70,000 miles, a few scuffs—and get a valuation: £6,000 for a private sale. It feels reasonable, maybe even modest, so you list it a bit higher because you’ve kept it running well. Selling privately is personal; it’s your car, your effort, and you want a fair return.

But it’s not always easy. Without a dealer’s market know-how, private sellers lean on online tools and instinct. A car with a solid history might hit £6,000, but missing paperwork or vague condition details can scare buyers off, dropping offers lower. Platforms like eBay and Auto Trader boost visibility, yet sales can drag on for weeks. There’s no safety net either—if a problem pops up post-sale, there’s no comeback. It’s a heartfelt effort, and they’re making do with what they have.

Dealers: The Unsung Workhorses Facing Hidden Risks

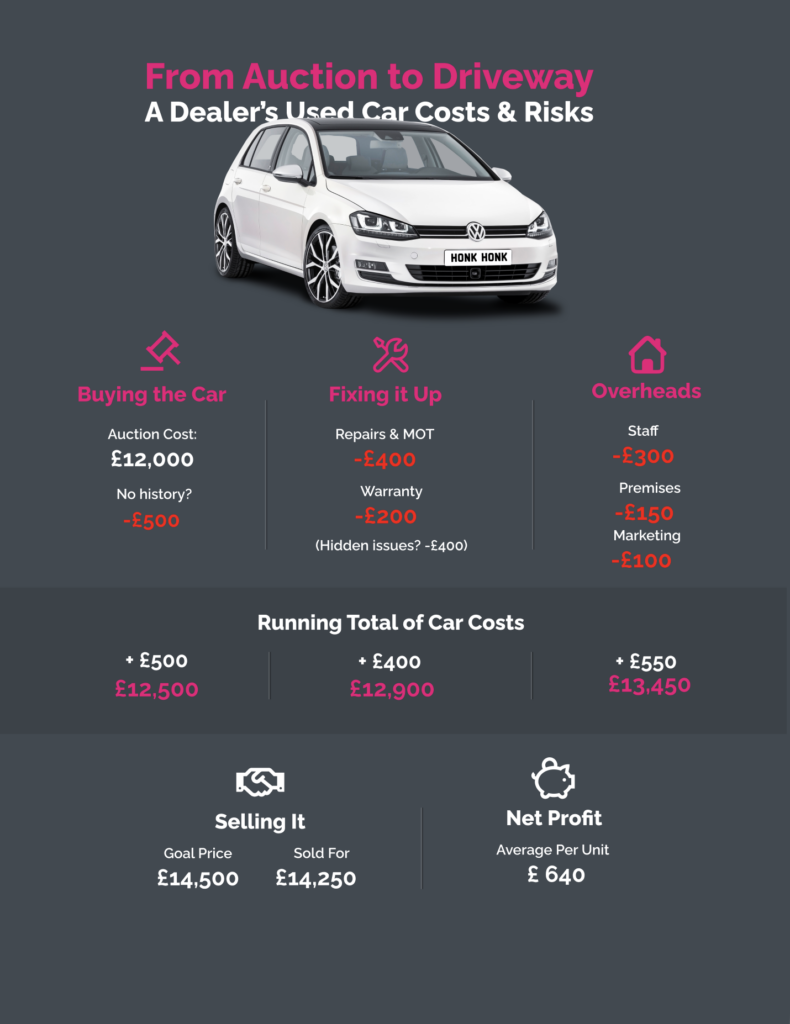

Now picture a dealer with that same Fiesta. They snag it for £5,500 at auction or from a private seller, aiming to sell at £7,500. That gap covers more than profit—it’s a lifeline. They’ve invested £400 in repairs and an MOT, £200 for a warranty, and overheads: £300 for staff, £150 for the showroom, £100 for ads. That’s £6,650 before it’s listed. They’re not just moving cars; they’re running a business with real stakes.

Risk looms large. If a seller skips full service history (FSH), omits detailed photos, or hides damage—like a knackered gearbox—it’s a gamble. No FSH can slash £500 off the value; blurry pics might miss a premium spec, costing £200–£300; undisclosed damage could turn a £300 fix into £800. That £1,850 profit? It could dwindle to £500—or vanish if the car lingers. Tesla’s recent share price drop—down 30% since mid-December 2024 after a 1.1% delivery decline and 23% profit dip—shows how fast market shifts can hit. Dealers feel that too, navigating tighter EV demand and rising costs (like Trump’s new 10% tariffs on Chinese imports affecting half of Tesla’s production).

Yet dealers go beyond. They carry out thorough inspections—something private sales can’t match—checking brakes, engines, and electrics to ensure reliability. If an issue crops up, even out of warranty, many step up with goodwill fixes, sometimes footing the bill themselves. Why? They know happy customers recommend them and return—unlike private sales, where you’re on your own. Dealers also sweeten the deal with finance options and extended warranties, easing the burden for buyers who need flexibility.

The Price Difference: Effort Meets Exposure

Why the gap? A 2015 Ford Focus might go for £5,000–£6,500 privately, while dealers list it at £6,000–£7,500. It’s not about outdoing each other—it’s what each offers. Private sellers bring affordability, but with uncertainty. Dealers deliver peace of mind—inspections, support, financing—and that takes resources and grit. Seasons shift prices—lower in winter, higher in spring—and economic pressures, like Tesla’s woes or buyer budget squeezes, keep everyone adapting. Online platforms help both shine, but dealers carry the weight when surprises strike.

A Shared Goal: Happy Buyers

Ultimately, private sellers and dealers aim for the same thing: satisfied buyers behind the wheel. Sellers pour heart into their listings, chasing a fair deal. Dealers pour effort—and risk—into every sale, building trust with inspections and support. Selling? Parkers gives a solid guide. Buying? Auto Trader shows both sides. The UK used car market thrives because everyone’s in it together—private sellers with passion, dealers with perseverance—making it work, one car at a time.